By Rohit Kothare on Apr 30, 2019 2:48:57 PM

Credit score plays a vital role in the home buying process. It’s how banks and other mortgage lenders find your ability to borrow and pay back in future.

A lot of first time home buyers with bad credit score face many problems. However, the fact is that you are not alone. A study has shown that millennials have a low credit score than the previous generation.

If you are in the same boat, don’t worry; homeownership could still be a reality for you. Let’s find out what options are available and what measures are needed to improve a low credit score.

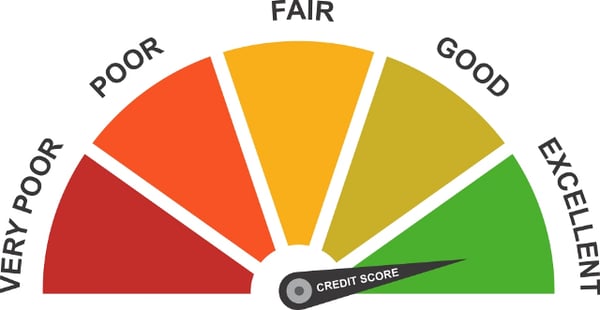

Source: thefinancialclinic.org/

Note: Indian institutions use a credit score gauge known as CIBIL (Credit Information Bureau India Limited) score to measure your creditworthiness. A credit score is based on the basis of your credit report which contains your credit history. The CIBIL range lies between 300 and 900. A high score implies a good credit history and a bad credit score means that there are high chances your credit/loan application would get rejected. Your credit report also takes into account public records such as any state taxes, central taxes, bankruptcies, or legal judgements against you.

Following are the bifurcation of credit score and what they mean:

- 300 – 579: new or poor credit

- 580 – 620: OK credit

- 621 – 740: good credit

- 741 and more - excellent credit

The numbers shown above provide a better understanding of credit score and its divided segments. However, bad credit doesn’t have to last forever.

Related Post - What are the available options for Home Financing in Pune?

Here are five things you should know if you are applying for a home loan with low CIBIL score:

Can you get a home loan with a poor credit score?

Source: Bankuponus Official Website

1. It is quite a common question among many prospective home buyers whether they can buy apply for a home loan if their credit score is bad.

Following some of these tactics can make your home buying process less of a hassle.

- Check eligibility for government mortgage loans

- Come up with a sizeable down payment - It will add as an advantage to your application. Lenders will appreciate more money upfront meaning less risk for them. So try to go for a sizeable down payment when applying for the loan.

- Look for community banks - Their lending criteria may be less rigid than that of nationalised banks.

2. Strictly following credit rules can help you raise your score a lot, quickly. Repairing a credit score is easier than you think. CIBIL scores continually fluctuate, so once you start a home purchase take steps to improve it.

Even if you increase the score by 10 points, you might be able to save a lot. A fraction of the difference in monthly payments can save lacs in the longer run.

.jpg?width=600&name=5%20things%20-%20Bad%20credit%20(1).jpg)

3. 35% of your credit score is made by your history of previous payments. The further behind you are on your payments, the more it hurts your credit score. Hence, pay all the dues remaining and then talk to your bank about the missed payments. The bank might be able to re-age your account, so your credit report shows that your debt is always paid on time.

4. Even small things count. You can show your creditworthiness by the following documents as well:

- Tax returns (at least the last three years)

- Details of your job history and salary slips

- List of assets such as home, car and property

- List of medical bills

- Proof of payment towards alimony or child support

Not all of these documents are required, but if you have a poor credit history, anything legible you produce is helpful.

5. Last but not least, buying a home can be a tedious process and takes a lot of time. Patience is something you need to have while you're repairing your credit because the credit score doesn’t improve overnight. Timely efforts will result in improvement and once they do, you will be ready to buy the home you always wished for.

Related Post - How to Save Tax on Real Estate Investment?

comments